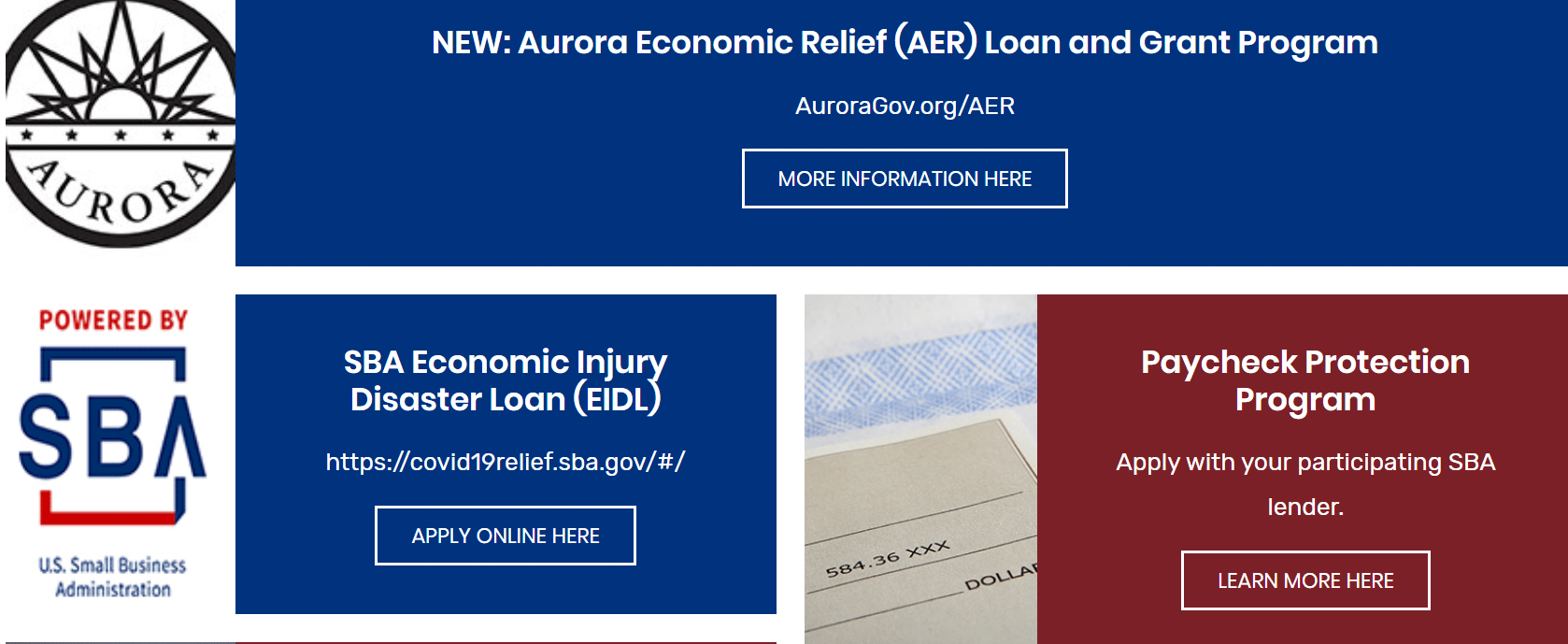

Restaurant, retail, service or entertainment small businesses and arts-related nonprofits in Aurora are invited to apply for financial assistance from the city of Aurora’s new $1 million Aurora Economic Relief (AER) Loan and Grant Program, in cooperation with CEDS Finance.

This local program fulfills an immediate funding need for Aurora small businesses waiting for additional funding assistance from state and federal sources.

Depending on the financial need, grants are available up to $5,000 or loans from $5,000 to $50,000 to help businesses retain jobs.

Minimum Qualifications for a Grant or Loan

To qualify for either a grant or loan, businesses must:

• Be based in Aurora with a physical location in the city (preferably with a storefront)

• Have 50 or fewer employees

• Be operating in Aurora for at least 12 months

• Have experienced a loss of income due to COVID-19

• Retain at least one low- to moderate-income job with this assistance (moderate income means less than or equal to 80% of the Area Median Income (AMI); see chart below for reference)

|

Number of Persons in Household |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

Median Average |

$65,000 |

$74,300 |

$83,600 |

$92,800 |

$100,300 |

$107,700 |

$115,100 |

$122,500 |

|

80% |

$52,000 |

$59,400 |

$66,850 |

$74,250 |

$80,200 |

$86,150 |

$92,100 |

$98,050 |

|

60% |

$39,000 |

$44,580 |

$50,160 |

$55,680 |

$60,180 |

$64,620 |

$69,060 |

$73,500 |

|

50% |

$32,500 |

$37,150 |

$41,800 |

$46,400 |

$50,150 |

$53,850 |

$57,550 |

$61,250 |

|

30% |

$19,500 |

$22,300 |

$25,100 |

$27,850 |

$30,100 |

$32,350 |

$34,550 |

$36,800 |

To qualify for a loan, businesses must meet these additional minimum requirements:

• Minimum credit score of 600 with no recent judgments or bankruptcies and no significant collections

• No more than two outstanding liens/debt for the business

• Annual revenue to be $2 million or less (prior to March 2020), with a 25% revenue decline in the same period 12 months prior

• Be in good standing with regulatory agencies

The loan interest rate will be 2%, with the initial loan term not to exceed five years (or with modifications and/or extensions, go up to seven years).

Businesses that apply here will be evaluated initially to ensure minimum qualifications are met. Qualified applicants will be contacted no later than April 23 with additional information regarding how to submit financial documents securely.

After Your Application is Accepted

Once the city has accepted your application, you will be contacted by email with a secure way to provide financial documents.

Grant program applicants must possess an Aurora business license, and upon request, submit a personal financial statement and 2019 tax return or year-end income statement, payroll and balance sheet.

Qualifying loan applicants will be asked to supply the last three to six months of business bank statements as well as the interim statement from this month and the last three months of personal bank statements; an income statement (for the past 12 months) and balance sheet (end of prior fiscal year); and a year-to-date income statement and balance sheet showing payroll expenses.

Due to funding limitations, qualified applicants who submit complete financial information as requested also will be evaluated based on these additional factors: number of jobs retained for low- and moderate-income people; urgency of need for resources; provides goods or services needed by—and are affordable to—low- and moderate-income residents; located in or near urban renewal area; is a minority, woman and/or immigrant-owned business; and percent of income loss.

Please note: Due to evaluation factors and funding limitations, applicants may meet minimum qualifications and submittal guidelines, but not receive funding.

Second Funding Cycle

A second funding cycle will start May 6. Previous qualifying applicants who did not receive funding during the first cycle will be considered for funding during the second cycle without having to reapply. New applicants also are welcome to apply during the second funding cycle.

More Information

If you have questions, we are here to help. Email us at [email protected].