The U.S.’s desire for Korean food has soared in the past decade. In 2019, Yelp reported that relative demand for the cuisine grew 140 percent in Phoenix, 80 percent in San Francisco, Portland, Seattle, and Boston, 70 percent in New York, and 50 percent in Atlanta, San Jose, Chicago, and Houston. American-based chains have cashed in on the craze. Early in 2021, Shake Shack released a Korean-inspired menu with Korean-Style Fried Chick’n and Korean Gochujang Chick’n Bites and Fries.

A good portion of the attraction can be traced to Korean band BTS, which has developed a large following in the U.S. and around the world. McDonald’s leveraged the group’s marketability to promote a celebrity meal deal in late May.

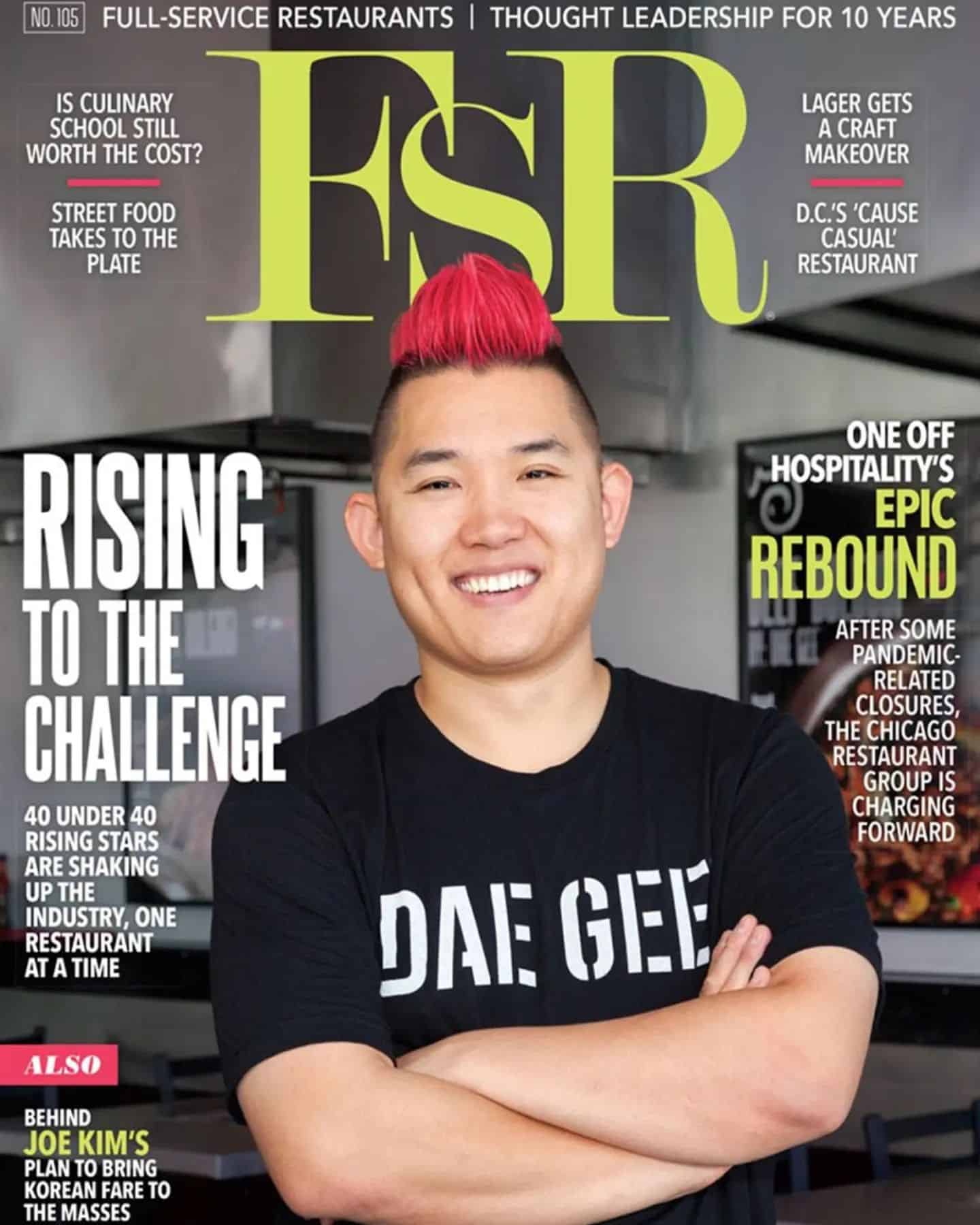

Dae Gee, which means “pig” in Korean, features offerings like Sogogi Bulgogi, or sliced rib-eye marinated in the restaurant’s exclusive barbecue sauce, and Joomulruk, or boneless beef rib meats seasoned with salt, pepper, and sesame oil. Customers are able to cook their own meat on grill tops at their tables and eat the meats in a bowl, hot stone pot, or as a wrap.

READ MORE: Inside the Rise of Korean Cuisine

The menu items have been perfected over the past decade. When Kim trained with his mother-in-law several years ago, he “eyeballed” recipes as opposed to following repeatable measurements. But over time, he realized Dae Gee’s growth potential within the market, and he knew it wouldn’t be possible to scale unless the back-of-house operations became more efficient. That’s when the company decided to open a central kitchen where everything is prepared and then distributed to individual restaurants.

“All [restaurants are] really doing is putting it together in certain situations, plating it for the customers to cook, and making sure it’s the right [temperature] before it goes out for the customer,” Kim says. “Obviously there’s going to be more room and more areas where we can streamline.”

The restaurant’s current footprint ranges from 2,400 to 3,300 square feet, which is compact relative to the rest of the full-service segment. The upcoming franchises will be even smaller at 1,500 to 2,000 square feet. Kim and his partners chose this size because they felt it was the best range to maximize volume and ROI.

Only 10 employees are required, significantly lowering labor costs. Kim employed this lean staffing model early into his restaurant career because he wanted to be prepared in case most of his employees decided to leave. Although he didn’t have a global pandemic or ongoing hiring shortage in mind when he implemented the strategy, it has served him well in the past several months.

During the peak of COVID, Kim was cooking in the back, taking phone calls, and monitoring the delivery tablets.

“Because we’d been preparing and running our operations and having our labor costs super lean prior to the pandemic, I think that’s what’s been able to help us sustain and overcome the situation,” Kim says.

Although the U.S.’s familiarity with Korean culture has grown in recent years, there’s still much to learn, Kim says. There’s the expansive Koreatown in Los Angeles and a strip of Korean concepts in New York City, but nationwide, Kim says more needs to be offered.

Dae Gee wants to fill that void in the coming years.

“People have yet to really indulge themselves in the culture,” Kim says. “One strategy [for us] is working with PR just getting the word out about hey, there’s Korean-style foods out there. That’s definitely an aspect that we’re strategizing and trying to work on.”

Read the article and more at FSR’s website here.